You're in good hands

2min on the clock

Clear and flexible contracts, 100% customizable online, get insured in a few clicks. And termination is handled by Luko.

365 days a year

A question about the guarantees or contract? Our teams answer you every day (even on Sundays).

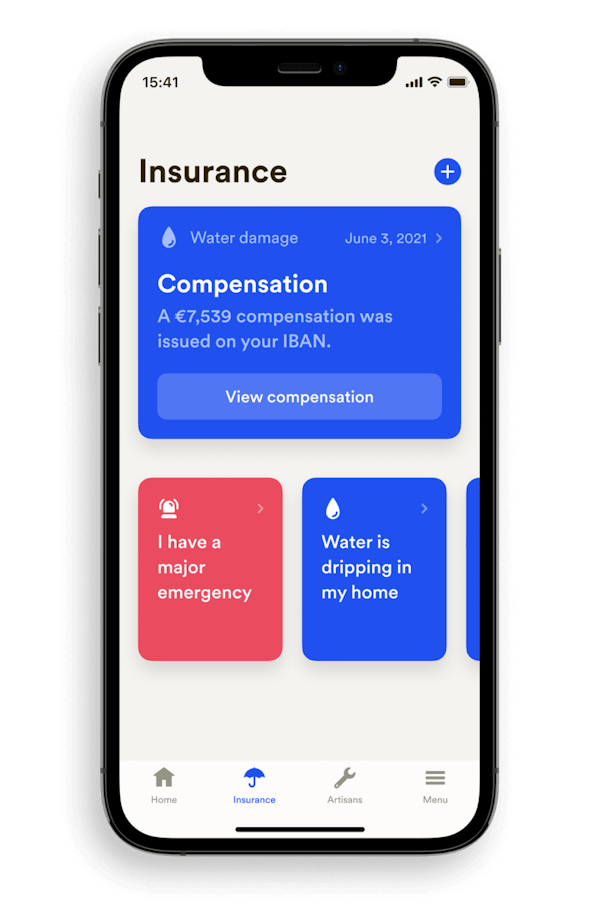

2x faster refunds

A problem? Report it on the application and we'll offer you the right solution before you've even said "wow".

Our commitments

To achieve our ambitions of providing useful and fair insurance to everyone, here are our commitments to you.

A fair price

Still not sure why the price of your insurance increases every year? At Luko, we're committed to building a transparent and fair model for everyone.

A transparent model

Luko reinvents insurance to propose a transparent model based on the principle of mutualization and redistribution. The objective? To finally align the interests of the users, the insurer and society.

5-star service

Our ambition is to offer you the ultimate service: available, responsive, caring. And for this, we measure our response time and customer satisfaction every week and every month.

Want to know where your money goes?

The traditional insurance model is built on a conflict of interests. The less they compensate your claim, the more money they make. We don't agree with that way of doing things, and prefer a far more transparent model.

30% of your premium is dedicated to Luko's management costs.

Customer service, claims management, innovation, etc.

70% is pooled with our other members’ premiums.

If you ever file a claim, that pool will be used to compensate you.If there’s money left at the end of the year, it’s donated to the charity of your choice.

It doesn't increase our profits. That's just not how we like to work.

We're here for you

Do you have a question about your coverage or your contract? Our advisors are available on chat or by email from 8am to 9pm on weekdays and from 9am to 8pm on weekends. Do you have a problem at home? Report it on the Luko application and a dedicated manager will take over to find you the solution you need.

Already insured? Luko takes care of everything.

Sign up to Luko and our team will do the rest. We guarantee a seamless transition from your former contract to your new Luko contract, without double coverage or risk of interruption.

Insure your home in less than 2 minutes

on luko.eu

Share your contract information

from your former insurance

We cancel it for free

for you

Your Luko contract starts

as soon as the old one ends